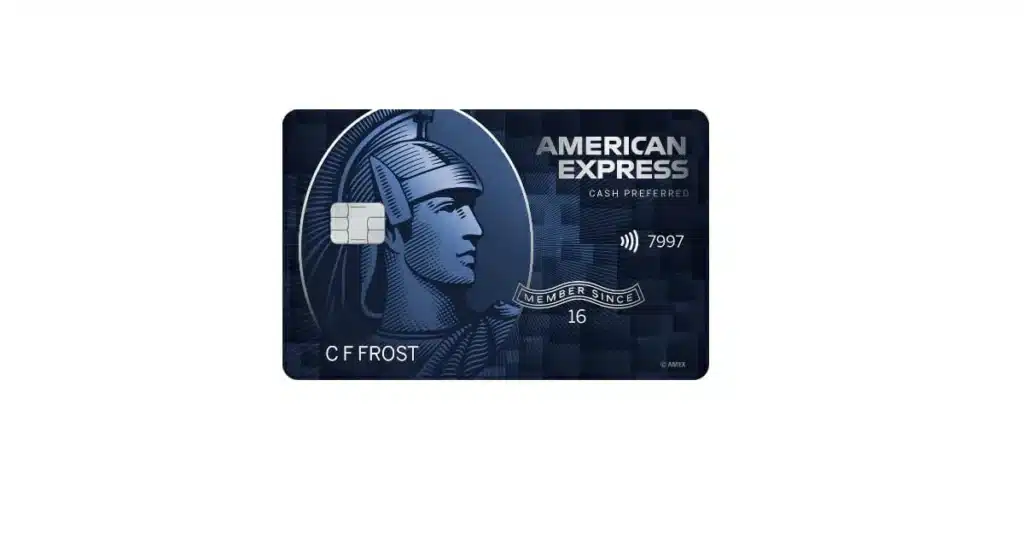

Blue Cash Preferred® Card from American Express: A Comprehensive Guide to Features, Benefits, and How to Apply

The Blue Cash Preferred® Card from American Express is one of the most sought-after credit cards for cashback rewards, especially for those who frequently shop at supermarkets and gas stations. Known for its robust rewards program, this card offers impressive earning potential, making it an ideal choice for individuals who want to maximize their cashback on everyday purchases. Whether you're looking to save on groceries, earn rewards for your gas purchases, or enjoy other special perks, the Blue Cash Preferred® Card from American Express is designed to meet your needs. In this guide, we’ll break down all the important details of this card, including its benefits, fees, and how you can apply.

What is the Blue Cash Preferred® Card from American Express?

The Blue Cash Preferred® Card from American Express is a rewards credit card that offers high cashback rates across several categories. It is issued by American Express, a globally recognized financial services company known for providing premium cards with excellent benefits. The Blue Cash Preferred® Card is particularly attractive to those who spend heavily in categories like supermarkets, gas stations, and select streaming services. Additionally, it comes with a generous sign-up bonus and an introductory 0% APR on purchases and balance transfers for a limited time.

Key Features of the Blue Cash Preferred® Card from American Express

- Cashback Rewards ProgramOne of the major highlights of the Blue Cash Preferred® Card is its cashback rewards program. The card offers one of the highest cashback rates in the industry, especially for specific categories. Here’s a breakdown of how you can earn cashback with this card:

- 6% cashback on the first $6,000 spent per year at U.S. supermarkets (then 1%). This is one of the best rates available for grocery shopping, making this card ideal for families or anyone who regularly buys food and household items.

- 3% cashback on U.S. gas station purchases and transit. This includes purchases at gas stations, parking, tolls, trains, buses, and even ride-sharing services like Uber or Lyft.

- 1% cashback on all other purchases. While this rate isn’t as high as the rewards for groceries and gas, it’s still a great way to earn cashback on general spending.

- Generous Sign-Up BonusThe Blue Cash Preferred® Card from American Express offers an enticing welcome bonus for new cardholders. As of 2024, new applicants can earn $300 in statement credits after spending $3,000 on purchases in the first 6 months of card membership. This bonus is a great incentive, especially if you plan on making significant purchases shortly after opening the account.

- 0% Introductory APR on Purchases and Balance TransfersFor those who plan to make large purchases or transfer high-interest debt, the Blue Cash Preferred® Card offers a 0% introductory APR on purchases and balance transfers for the first 12 months. After the introductory period ends, a variable APR will apply, which is competitive but higher than many other credit cards. This 0% APR offer allows cardholders to make purchases and pay them off over time without accruing interest during the promotional period.

- No Annual Fee for the First YearThe Blue Cash Preferred® Card comes with an annual fee of $95 after the first year. However, if you are a new cardholder, the first year’s annual fee is waived, meaning you can enjoy the benefits of this card for free during your first year. This is a fantastic perk for those who want to try out the card without the commitment of an annual fee right away.

- Additional Benefits and ProtectionsIn addition to its cashback rewards and introductory offers, the Blue Cash Preferred® Card from American Express comes with a range of valuable benefits:

- Purchase Protection: Purchases made with your Blue Cash Preferred® Card are protected by Purchase Protection, which covers theft or damage of eligible items.

- Return Protection: If you try to return an item to a merchant but they refuse, American Express will help you return the item and issue a refund within a certain period.

- Car Rental Insurance: When renting a car using your Blue Cash Preferred® Card, you’ll get coverage for damage or theft for up to 30 days.

- Access to American Express Offers: Cardholders get exclusive access to special offers and discounts at a variety of retailers, including major department stores, restaurants, and online merchants.

- Fraud Protection: American Express provides 24/7 fraud protection, including the ability to lock and unlock your card via the American Express mobile app.

- Flexible Redemption OptionsRewards earned with the Blue Cash Preferred® Card are in the form of cashback. You can redeem your cashback as a statement credit, a check, or direct deposit into your bank account. This flexibility makes it easy to use your rewards however you see fit. Keep in mind that cashback is earned as you spend and can be redeemed at any time.

- No Foreign Transaction FeesIf you travel abroad, the Blue Cash Preferred® Card from American Express will not charge you any foreign transaction fees on purchases made outside the U.S. This is an excellent feature for frequent travelers who want to avoid the additional costs that some credit cards impose when used internationally.

How to Apply for the Blue Cash Preferred® Card from American Express

Applying for the Blue Cash Preferred® Card is a simple process that can be completed online through the American Express website. Here’s a step-by-step guide to help you apply:

- Check Your Credit Score

The Blue Cash Preferred® Card is best suited for individuals with good to excellent credit, generally a score of 700 or higher. It’s a good idea to check your credit score before applying to ensure you meet the card’s creditworthiness criteria. - Gather Your Personal Information

To apply for the card, you’ll need to provide basic personal information, such as:- Your full name and contact details

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your income and employment status

- Your housing payment details

- Visit the American Express Website

Go to the official American Express website and navigate to the Blue Cash Preferred® Card application page. There, you will be able to read through the card’s features and benefits and begin the application process. - Complete the Application Form

Fill out the application form with the required information. Make sure to double-check all the information for accuracy to avoid delays or complications in the approval process. - Wait for Approval

Once submitted, American Express will review your application. In many cases, you will receive an instant decision. However, it could take a few business days to process your application if additional information is needed. - Activate Your Card

After approval, you will receive your Blue Cash Preferred® Card in the mail within 7 to 10 business days. To start using the card, you will need to activate it either online or by calling the activation number provided with the card.

Conclusion

The Blue Cash Preferred® Card from American Express is a powerful rewards credit card, especially for those who regularly spend money on groceries, gas, and transit. Its attractive cashback rates, sign-up bonus, and valuable benefits make it a top contender for anyone looking to maximize their everyday spending. Whether you are using the card for groceries, filling up your gas tank, or taking advantage of the rewards for streaming services, this card is designed to offer exceptional value.

With a relatively low annual fee (which is waived in the first year) and no foreign transaction fees, the Blue Cash Preferred® Card from American Express provides a wide range of rewards and benefits that can enhance your financial flexibility. If you’re ready to start earning cashback on your purchases, applying for the Blue Cash Preferred® Card is a straightforward process that can set you on the path to financial rewards.

Related